Hi

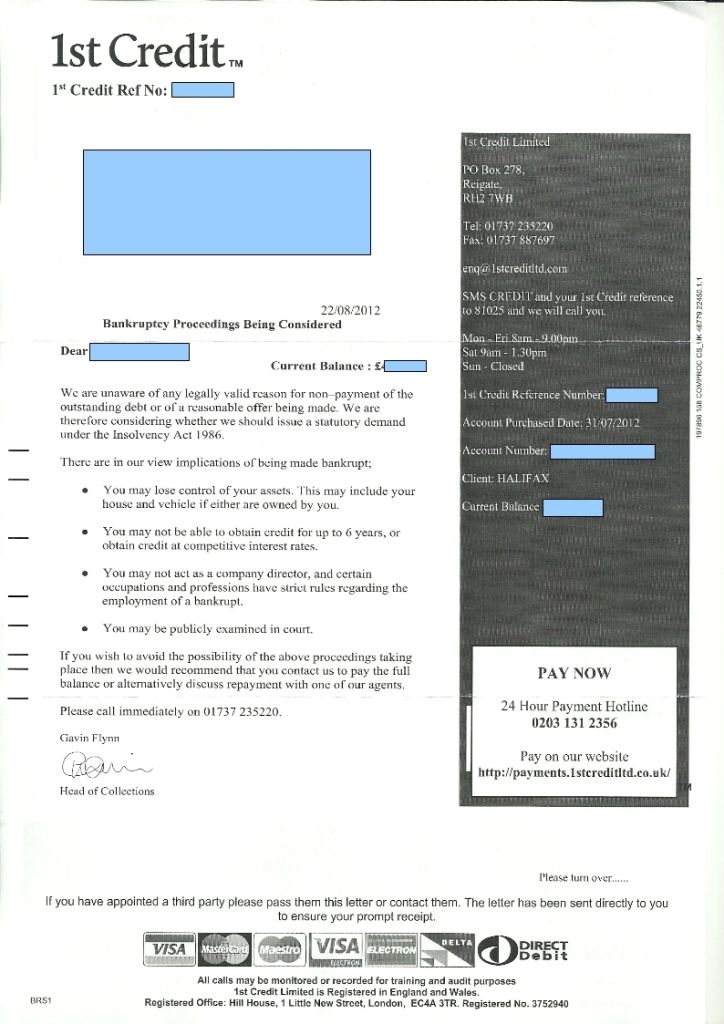

I notice 1st Credit have recently purchased a tranche of HBOS agreements which usually starts with them sending a Notice of Assignment followed by some lame threat, usually a threat to make you Bankrupt.

Now the thing with 1st Credit is that they make these threats deep in the knowledge that they have already been warned against it by the OFT - Link Here.

So as you can see, they have not learned their lesson nor have they adhered to the OFT Requirements. 1st Credit will argue that they do intend to make you BR so the OFT requirements are not reflective - they are surely mistaken. The actual truth of the matter is that they must not issue threats of BR willy-nilly without good cause and justifiable within the standards of a bankruptcy petition. This means they cannot issue BR threats for small debts, disputed debts, debts that they are not assigned and most importantly debts that are in the middle of an ongoing dispute prior to their involvement.

I'm trying to explain that 1st Credit must consider the fact that most of you here have been going down the unenforceability route for some time with disputed aspects of the paperwork issued. 1st Credit must take this genuine dispute into account, it'd be easier if they actually returned the account the the bank which is what this thread centres around, so in a nutshell the aim of this thread is to go through a basic guide that will allow you an opportunity to get 1st Credit to play fair and treat you like a consumer with rights, as opposed to treating you like a 'dirty debt dodger'.

I have full permission from the site team to create this thread and I have been verified by Niddy and various other mods. Clearly I am an AE of a regular user here that wishes to remain anonymous.

Good Luck.

I notice 1st Credit have recently purchased a tranche of HBOS agreements which usually starts with them sending a Notice of Assignment followed by some lame threat, usually a threat to make you Bankrupt.

Now the thing with 1st Credit is that they make these threats deep in the knowledge that they have already been warned against it by the OFT - Link Here.

OFT said that an investigation had revealed that 1st Credit had failed to meet “satisfactory standards” and was ordered to stop using threats of bankruptcy to recover money when there was never an intention to bring about bankruptcy proceedings. 1st Credit must now report to OFT every 6 months with details of the enforcement actions that it has taken against debtors, which could also mean a £50,000 and a revocation of it’s consumer credit licence.

I'm trying to explain that 1st Credit must consider the fact that most of you here have been going down the unenforceability route for some time with disputed aspects of the paperwork issued. 1st Credit must take this genuine dispute into account, it'd be easier if they actually returned the account the the bank which is what this thread centres around, so in a nutshell the aim of this thread is to go through a basic guide that will allow you an opportunity to get 1st Credit to play fair and treat you like a consumer with rights, as opposed to treating you like a 'dirty debt dodger'.

I have full permission from the site team to create this thread and I have been verified by Niddy and various other mods. Clearly I am an AE of a regular user here that wishes to remain anonymous.

Good Luck.

Comment